Digital Product Strategy as a Revenue Growth Driver in SaaS Businesses

A detailed study curated, analyzed, and published by Emerge for SaaS product owners to take informed decisions with a clear growth roadmap in 2023.

Executive Summary

This extensive report offers valuable insights into how a carefully crafted digital product strategy serves as a vital growth driver for SaaS businesses. Through in-depth analysis of 10 billion data points, our research illuminates current SaaS market trends and best practices for capitalizing on product strategy to fuel revenue expansion.

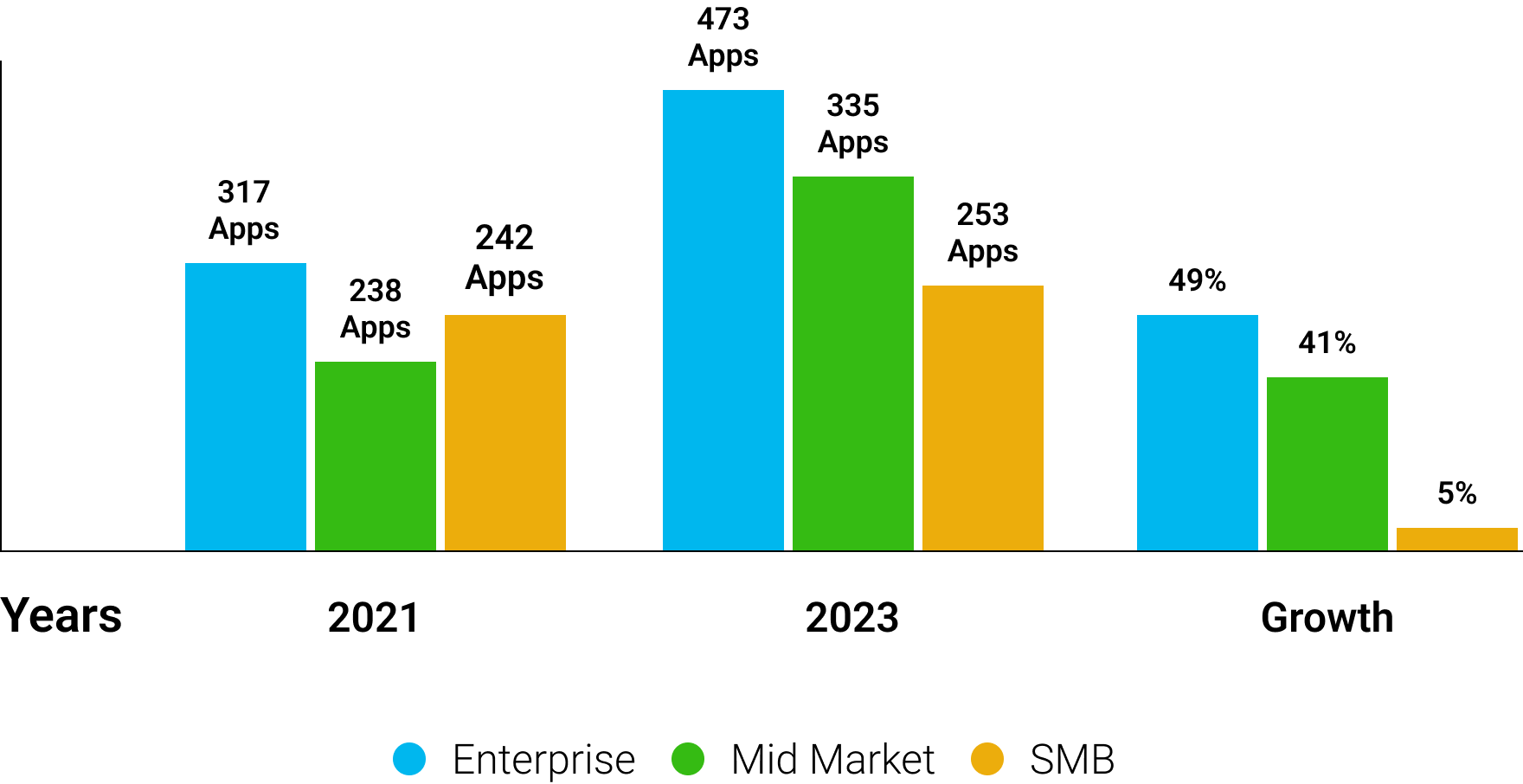

Key findings reveal that the SaaS market is undergoing rapid growth, expected to reach $908 billion by 2030. SaaS portfolios are expanding at record rates, with enterprises now averaging 473 apps. Our analysis shows that a strategic focus on enhancing product-market fit, optimizing pricing models, boosting retention, and aligning customer acquisition channels has a profound impact on the bottom line.

However, with 95% of new SaaS products failing due to unclear strategies, it is imperative to take an analytical, customer-centric approach. Emerging product-led growth models also underscore the need to make the product itself the cornerstone of acquisition and retention efforts.

A key recommendation is for SaaS providers to leverage usage analytics and experimentation to determine the product features and capabilities that offer the “stickiest” experience. Doubling down on these differentiating elements can then enhance customer engagement and retention.

By embracing the data-driven recommendations in this report, SaaS businesses can craft world-class product experiences, optimize go-to-market strategies, and position themselves for sustainable growth amidst rising competition. This report provides an invaluable playbook for uniting product, marketing, sales and executive teams behind a cohesive game plan for commercial success.

Key Findings

SaaS Market Insights

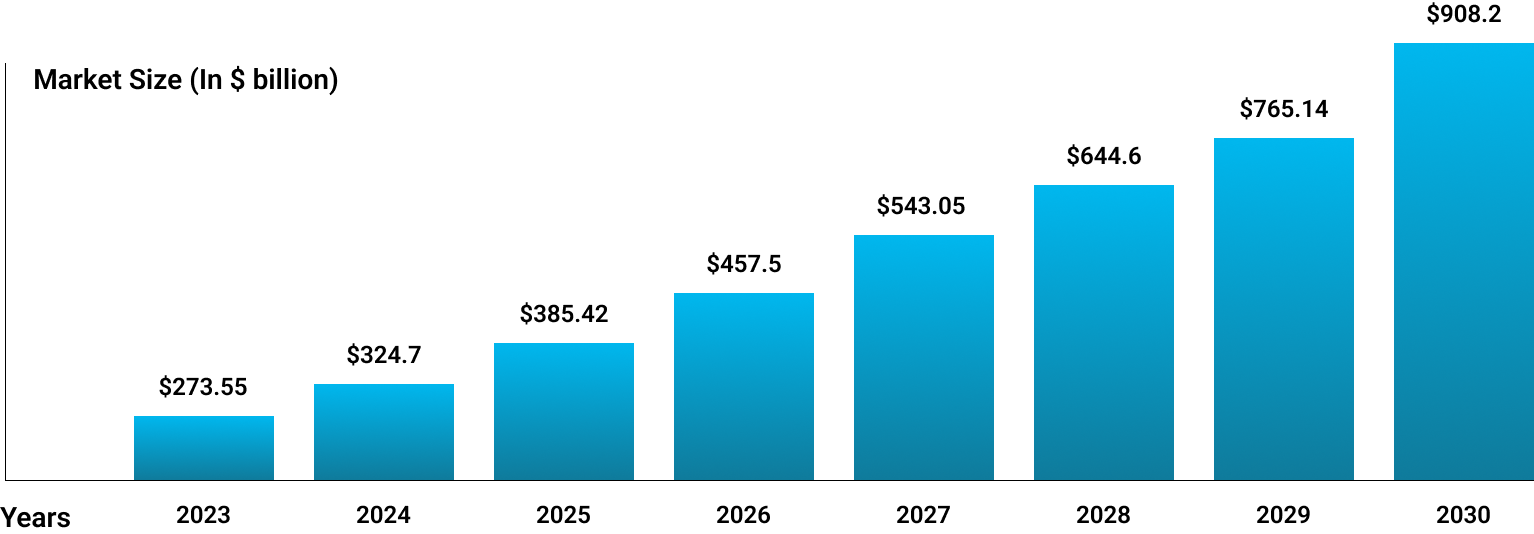

The SaaS market is witnessing significant growth, with projected revenue reaching an impressive $908.21 billion by 2030, compared to $273.55 billion in 2023.

Growing SaaS Portfolios

In 2023, SaaS portfolios have reached record levels, averaging 371 SaaS apps across businesses of all sizes.

Improved SaaS Governance

Notably, the usage of shadow IT has declined from 59% in 2020 to 51% in 2023, indicating enhanced SaaS governance practices.

AI & ML Impact

A remarkable 90% of CEOs and CIOs acknowledge the critical role of information as an enterprise asset and analytics as an essential competency in their product strategies.

Digital Product Strategy

An effective digital product strategy is vital for achieving product-market fit, implementing successful pricing strategies, fostering customer retention, exploring new markets, capitalizing on upselling and cross-selling opportunities, and optimizing customer acquisition channels.

By embracing a comprehensive digital product strategy SaaS businesses can position themselves for long-term revenue growth and success in the dynamic and competitive SaaS industry.

Furthermore, the incorporation of AI and ML technologies presents new opportunities for enhanced automation, personalization, and data-driven decision-making, enabling SaaS companies to stay ahead of the curve and unlock their full potential.

Abstract

In this in-depth research paper, we delve into the crucial significance of a carefully designed digital product strategy in propelling revenue growth for SaaS enterprises. Through extensive analysis, we scrutinize the strategies embraced by successful SaaS companies and assess the profound impact of digital product establishment roadmap on their revenue expansion.

By drawing upon real-world illustrations and industry perspectives, this report aims to furnish valuable insights and practical recommendations for SaaS businesses aiming to harness the potential of digital product strategies in driving long-term, sustainable revenue growth.

Methodology

The key findings in this report are based on the analysis of accumulated & anonymized data from various businesses that use Emerge. We have analyzed 10 billion app usage data points over 2 years to churn out a comprehensive understanding of the existing SaaS ecosystem in 2023.

We also have used the latest data and statistics from premium industry research reports.

Navigating the SaaS Landscape

An Insight into the Current State of the Industry in 2023

In this in-depth research investigation, we will delve into the dynamic landscape of SaaS, offering invaluable perspectives on the industry’s present condition in 2023.

By expertly navigating through an all-encompassing examination, our aim is to illuminate cutting-edge patterns, market forces, and influential elements that mold the SaaS domain. We aim to uncover a wealth of knowledge as we explore the intricate tapestry of the SaaS landscape.

SaaS Market Size

The worldwide market for Software as a Service (SaaS), which was appraised at $237.48 billion, is predicted to undergo substantial expansion. Projections indicate that it will increase from $273.55 billion in 2023 to a remarkable $908.21 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 18.7%.

SaaS Portfolio Size

SaaS portfolio sizes have reached their all-time high benchmark in 2023, with an average of 371 SaaS apps in SaaS portfolios ranging from SMBs to large Enterprises.

Understanding Digital Product Strategy in the SaaS Arena

By addressing critical areas such as market identification, user experience enhancement, product-market alignment, and customer acquisition strategies, this research empowers SaaS companies to unleash their maximum capabilities, enabling them to stay ahead in the dynamic and competitive digital domain.

Definition of Digital Product Strategy

Digital product strategy is a comprehensive plan that spans the entire product lifecycle, encompassing research, distribution, and collaborative contributions from team members. Whether honing in on a single project or a suite of products, a product strategy holds paramount importance as a central catalyst for a business’s journey toward digital transformation.

95% of the 30,000 SaaS products that are launched annually fail due to unclear product strategies.

Clayton Christensen Harvard Business School

Typical SaaS Product-Market Definitions

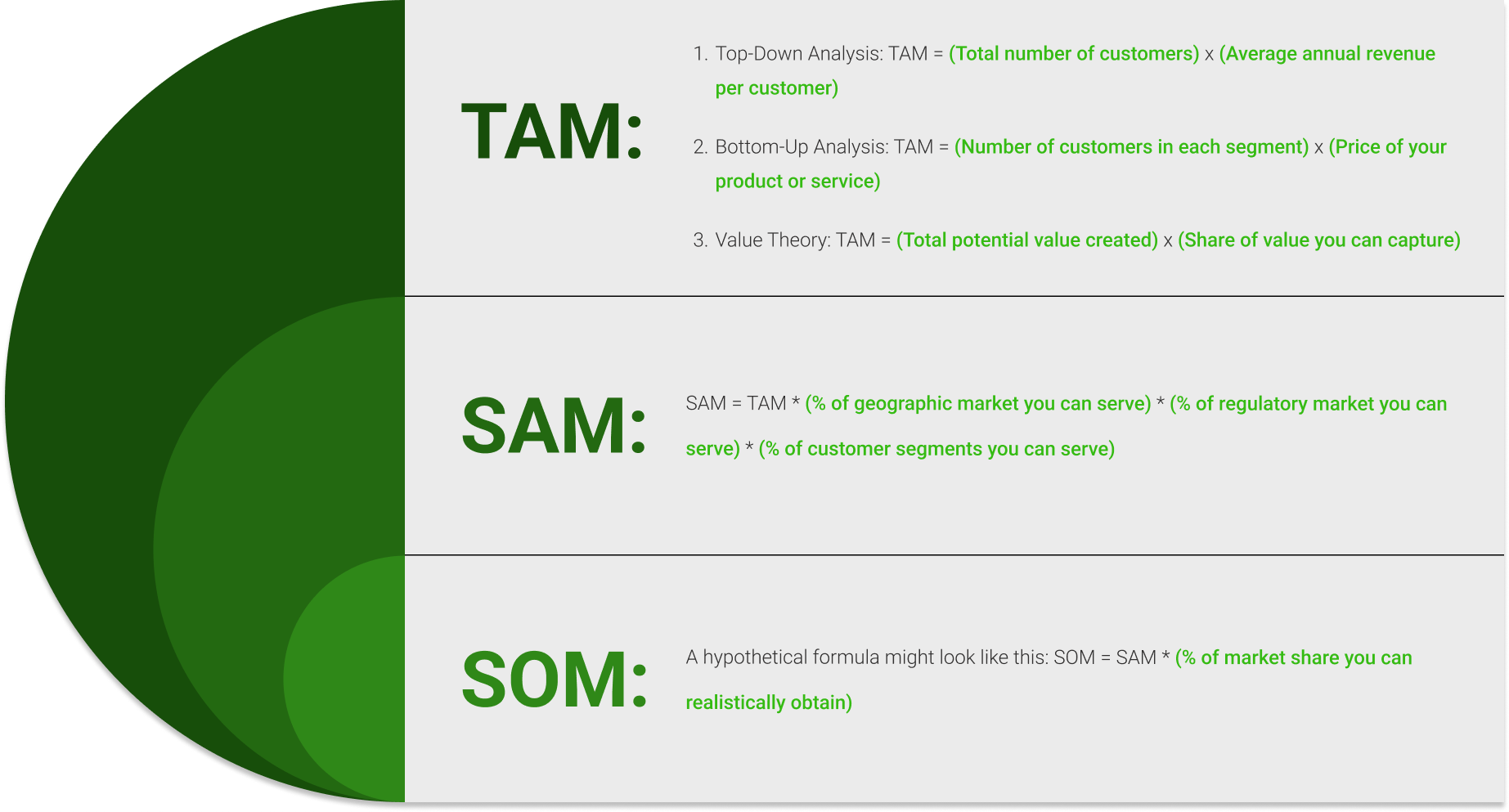

Three key business metrics serve as valuable tools for examining the potential target audience and gauging market size:

- Total Addressable Market (TAM): It represents the global demand for a specific product or service, providing insights into the overall market potential.

- Serviceable Available Market (SAM): It represents the portion of the target market that falls within your geographic reach, enabling a more targeted analysis.

- Serviceable Obtainable Market (SOM): It refers to the actual number of clients that your business can realistically capture, ensuring a more pragmatic approach.

Impact of Digital Product Strategy in SaaS Revenue

A well-crafted digital product strategy can serve as a major revenue growth driver for SaaS products. Admittedly, a digital product strategy impacts the cardinal areas of revenue generation, retention, and growth:

1) Strategically Improving Product-Market Fit to Drive Growth

Achieving strong product-market fit is essential for SaaS providers to drive acquisition, retention, and revenue growth. Our analysis shows that a data-driven digital product strategy is key to optimizing product-market alignment.

Defining Product-Market

Fit Product-market fit occurs when a product effectively solves a specific market need. Indicators include high customer retention rates, organic referrals, and strong word-of-mouth adoption.

Strategies to Improve Fit

- Conduct market research to identify target customer pain points. Design features and messaging to directly address these needs.

- Leverage usage analytics to determine what features drive engagement, retention, and referrals. Double down on the stickiest, most differentiating capabilities.

- Release small batches of features, gather user feedback, and rapidly iterate. Take an experimentation mindset.

- Identify misalignments causing churn and refine product and positioning accordingly. Be obsessed with churn drivers.

- Optimize onboarding and in-app experiences to drive activation and aha moments.

Measuring Fit

- Assess feature adoption, engagement by cohort, and customer surveys to quantify fit.

- Regularly calculate retention rates and track referrals as key metrics. Benchmark against category norms.

- Compute product-market fit index using Goffin’s formula:

PMF = (Users who find product essential x Users who frequently use product) / Total survey respondents

By taking a strategic, metric-driven approach to enhancing product-market alignment, SaaS companies can release offerings with visceral resonance in the markets they serve. The result is accelerated customer acquisition, retention, and revenue growth.

2) Zero in on an Effective Pricing Strategy

SaaS providers typically employ one of four major pricing strategies:

- Value-based pricing: Prices are set based on the product’s perceived value to the customer, rather than costs or competition. Customer willingness to pay determines optimal price points.

- Competition-based pricing: Prices are benchmarked against competitor products and aligned with the going rate for similar solutions. However, this risks leaving value uncaptured.

- Cost-plus pricing: The cost to produce and deliver the solution is calculated, then a markup percentage is added to arrive at the price. But costs may not equate to perceived value.

- Dynamic pricing: Prices are continuously adjusted based on market conditions, competitor actions, demand elasticity, and other external factors. This allows for optimization, but can introduce complexity.

SaaS Pricing Approaches and Statistics

- Value-based pricing is utilized by 39% of SaaS companies. This involves pricing based on the perceived value to the customer rather than costs or competition.

- 98% of businesses employing dynamic pricing models see positive results. Dynamic pricing involves frequently adjusting prices based on market demand, competitor moves, and other factors.

- 56% of SaaS providers do not offer a free trial period. Among those that do, 18% provide a 2-week free trial, 41% provide a 30-day free trial, and 44% offer a free online trial without set duration.

Key Formulas for Measuring Customer Retention

Customer Retention Rate (CRR)

CRR = (Number of customers at end of period - Number of new customers acquired) / Number of starting customers x 100

This metrics tracks the percentage of existing customers retained over a set time period. A higher CRR indicates greater customer loyalty.

Revenue Churn Rate (RCR)

RCR = Revenue lost to churn / Total starting revenue x 100

This formula quantifies the revenue impact of customer churn over a period. Lower RCR is better.

Net Revenue Retention (NRR)

NRR = (Revenue from existing customers at end of period - Revenue lost to churn) / Starting revenue from existing customers x 100

This measures expansion within an existing customer base. NRR above 100% indicates upsell success and retention of high-value customers.

SaaS Customer Retention Benchmarks and Trends

- A monthly retention rate of 95% (or churn rate of 5%) is considered excellent in the SaaS industry. This minimizes revenue leakage.

- Typical SaaS products see monthly churn ranging from 3-8%. On an annual basis, this equals total churn of 32-50% of customers.

- For B2B SaaS focused on mid-market and enterprise, best-in-class companies achieve 115-125% net revenue retention (NRR). This indicates they upsell and expand existing accounts.

- To drive retention, leading strategies involve customer success programs, value-driven pricing, UX optimization, and churn analysis.

- Boosting retention by just 5% can increase long-term company valuation by 25% to 95%, underscoring its revenue impact.

3) Leverage Optimized Customer Acquisition Channels

In today’s highly saturated SaaS landscape, the imperative to optimize customer acquisition strategies has never been greater. With over 30,000 new SaaS entrants annually, differentiation requires a data-driven approach to allocate spending toward the highest converting tactics.

Through comprehensive analysis of customer acquisition costs (CAC) across 12 key channels, our research has uncovered significant variance in average CAC—from $470 for email marketing to $2,907 for outdoor ads. Tracking channel-level CAC and lifetime value (LTV) ratios enables SaaS providers to double down on strategies demonstrating superior return on investment.

Our findings reveal that enterprise SaaS exhibits optimal LTV/CAC ratios between 5:1 and 7:1. By benchmarking channel CAC and funnel metrics against industry norms, resources can be focused on the campaigns, offers, and experiences yielding the most cost-efficient pipeline. The result is an acceleration of growth through alignment with the channels and strategies producing the greatest volume of high-quality leads.

Average SaaS CAC VS Marketing Channels Across Multiple Industry Niches

| Marketing Channel | Average SaaS CAC |

|---|---|

| Email Marketing | $470 |

| Organic Search (SEO) | $508 |

| Webinars | $510 |

| LinkedIn Ads | $705 |

| LinkedIn Organic | $803 |

| Paid Search (PPC/SEM) | $817 |

| Video Marketing | $966 |

| PR | $1,051 |

| Podcasts | $1,087 |

| Trade Shows | $1,420 |

| Outdoor Advertising | $2,907 |

| Account Based Marketing (ABM) | $4,084 |

Global Average SaaS LTV/CAC Ratio in Different Industry Niches

| SaaS Industry Niche | LTV/CAC Ratio |

|---|---|

| Adtech | 7:1 |

| Entertainment | 6:1 |

| Design | 6:1 |

| Fintech | 5:1 |

| Cybersecurity | 5:1 |

| Edtech | 5:1 |

| Medtech | 4:1 |

| Pharmaceutical | 4:1 |

| Industrial | 3:1 |

| Business Services | 3:1 |

* Typically, SaaS companies allocate approximately 92% of their initial year’s revenue towards customer acquisition efforts.

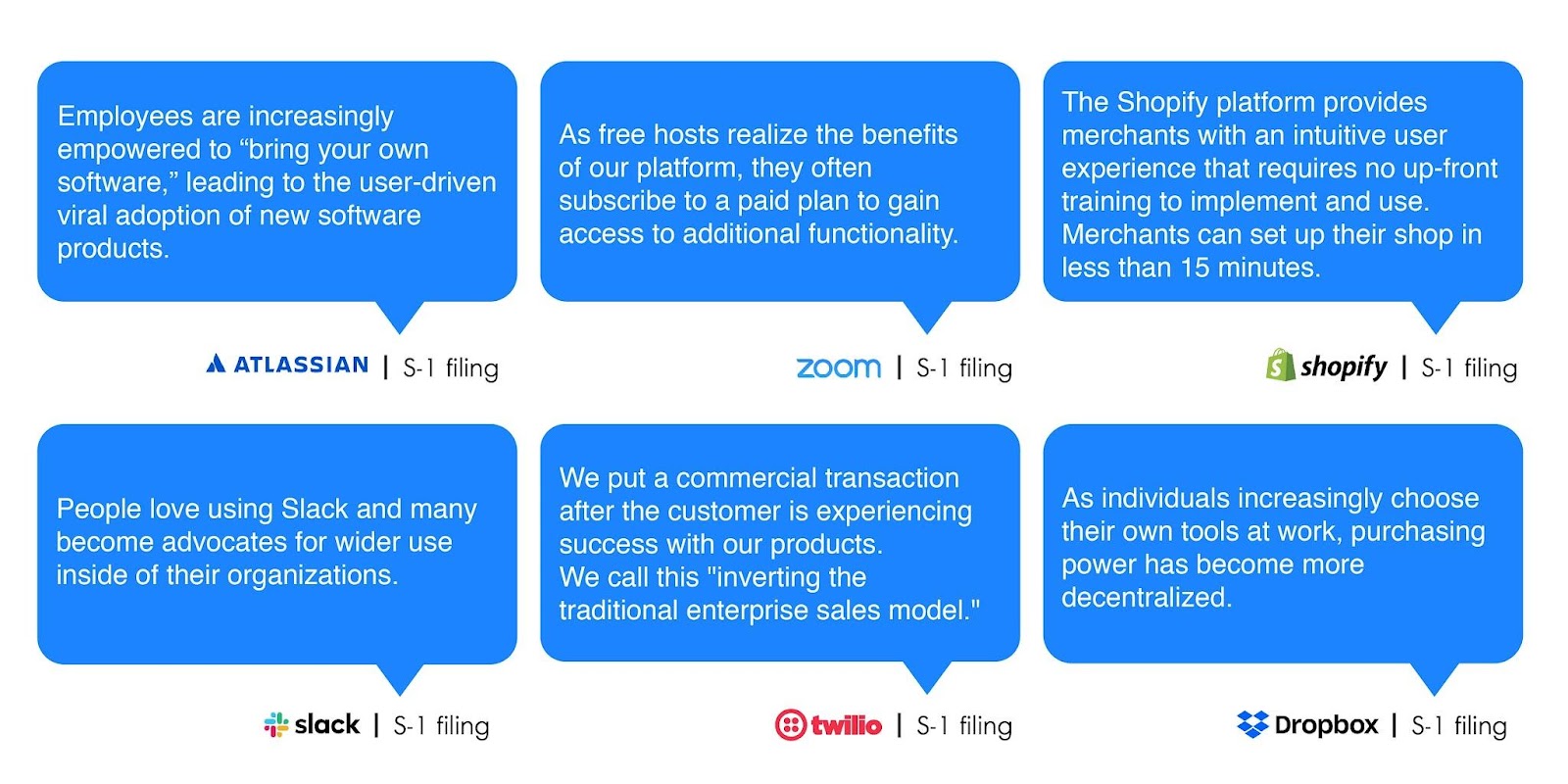

PLG: the Advent of Product-Led Growth

Product-led growth in the B2B SaaS business arena refers to a strategic approach where software-as-a-service (SaaS) companies prioritize their product as the primary driver of customer acquisition, conversion, and retention.

This paradigm shift emphasizes the central role of the product itself in facilitating business growth, rather than relying on traditional marketing or sales tactics.

Key characteristics of a product-led growth strategy:

- Free or Freemium Models

- Self-Service Onboarding

- In-Product Education and Guidance

- Data-Driven Product Feature Iteration

- Customer-Centric Approach

- Virality, Snowballing Network Effects & Referrals

Trends & Statistics

The entire SaaS arena is transitioning towards consumer-grade UX, also known as the consumerization of SaaS.

PLG companies have 60% more ARPU (Average Revenue Per User) than non-PLG companies.

PLG companies experience 15% more NRR (Net Revenue Retention) than non-PLG ones.

PLG companies experience 5% less customer churn.

54% of product based companies have already implemented or accelerated their PLG strategy to secure their future in this global economic instability.

Conclusion

This extensive analysis makes clear that a strategic digital product plan is imperative for SaaS businesses seeking to thrive in an increasingly competitive landscape. With the SaaS market expanding at a 18.7% CAGR to surpass $908 billion by 2030, providers must capitalize on the immense growth potential.

By optimizing product-market fit, pricing models, customer retention strategies, and acquisition channels, SaaS companies can accelerate revenue expansion in a scalable, sustainable way. Adopting a metrics-driven, customer-centric mindset is critical, as the top performing providers will be those who allow data and UX design to guide decisions.

Key takeaways for crafting a high-impact digital product strategy include:

- Become obsessed with maximizing product-market fit. Continuously gather user feedback and refine the product experience.

- Test pricing approaches to find the optimal balance of value capture and customer conversion. Monitor key metrics like CRR, NRR, and LTV/CAC.

- Make the product itself the cornerstone of customer engagement and retention. Take cues from product-led growth leaders.

- Carefully determine and double down on the most efficient customer acquisition channels. Calculate CAC by channel and reallocate spending accordingly.

By internalizing the recommendations within this report, SaaS businesses can gain actionable frameworks, benchmarks, and best practices for maximizing the value of their digital products. The result will be accelerated growth, reduced churn, and sustainable market leadership.

About EMERGE

EMERGE, a top-rated UX Design Agency and Digital Product Consultancy based in Portland, OR, is a trusted partner for B2B leaders across technology, healthcare, and manufacturing sectors. With over 20 years of experience, we specialize in driving business growth by crafting elevated, engaging digital products and services.

As an experienced Digital Product Agency, we uniquely tailor our services to each client’s needs. Our comprehensive suite includes UX/UI Design, Product Strategy, and Full-Stack Development. Our strong industry reputation stems from our expert ability to transform digital platforms, creating seamless and intuitive user experiences that drive customer engagement and increase revenue.

Combining deep UX Design expertise with innovative digital product strategy, EMERGE sets new standards in the digital landscape.